All Categories

Featured

Table of Contents

Repayments can be paid monthly, quarterly, every year, or semi-annually for a surefire amount of time or permanently, whichever is defined in the agreement. Just the interest part of each settlement is taken into consideration gross income. The rest is taken into consideration a return of principal and is complimentary of earnings tax obligations. With a postponed annuity, you make normal costs settlements to an insurance policy firm over an amount of time and allow the funds to construct and make interest during the accumulation stage.

This indicates an annuity might help you gather a lot more over the long term than a taxable financial investment. Any incomes are not exhausted until they are taken out, at which time they are considered normal revenue. A variable annuity is a contract that supplies varying (variable) instead of fixed returns. The essential feature of a variable annuity is that you can control just how your premiums are spent by the insurance provider.

Many variable annuity agreements use a variety of professionally taken care of portfolios called subaccounts (or financial investment options) that purchase stocks, bonds, and money market instruments, in addition to well balanced investments. Some of your payments can be placed in an account that supplies a set price of return. Your costs will be designated among the subaccounts that you select.

These subaccounts fluctuate in value with market conditions, and the principal may deserve essentially than the initial cost when surrendered. Variable annuities offer the double benefits of investment flexibility and the possibility for tax deferral. The taxes on all interest, returns, and funding gains are delayed up until withdrawals are made.

Analyzing Fixed Annuity Or Variable Annuity Key Insights on Your Financial Future What Is Fixed Vs Variable Annuity Pros And Cons? Features of Smart Investment Choices Why What Is A Variable Annuity Vs A Fixed Annuity Matters for Retirement Planning Fixed Annuity Or Variable Annuity: How It Works Key Differences Between Fixed Vs Variable Annuity Pros Cons Understanding the Key Features of Fixed Annuity Or Variable Annuity Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

The program, which includes this and various other info concerning the variable annuity agreement and the underlying financial investment alternatives, can be acquired from your monetary specialist. Make certain to review the prospectus carefully before making a decision whether to invest. The details in this newsletter is not planned as tax, legal, financial investment, or retirement recommendations or recommendations, and it may not be depended on for the function of preventing any government tax obligation fines.

2025 Broadridge Financial Solutions, Inc.

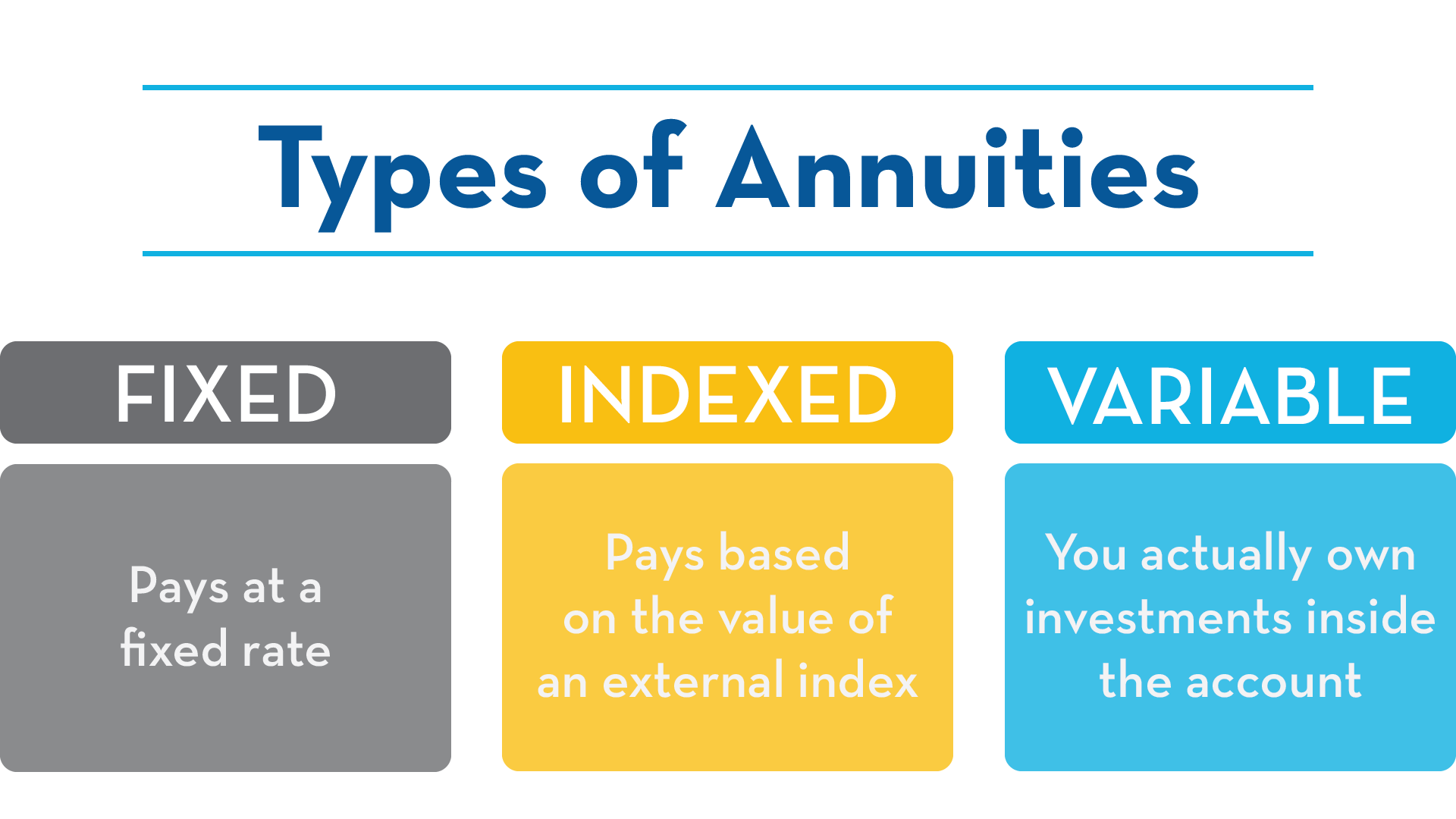

Two of the most common options consist of dealt with and variable annuities. The main difference between a dealt with and a variable annuity is that taken care of annuities have an established price and aren't linked to market performance, whereas with variable annuities, your eventual payout depends on just how your picked investments carry out.

You can pick just how much cash you desire to add to the annuity and when you wish to start obtaining revenue repayments. Normally talking, taken care of annuities are a predictable, low-risk way to supplement your revenue stream. You can fund your repaired annuity with one round figure, or a collection of settlements.

You can money a repaired or variable annuity with either a round figure, or in installations in time. The majority of the moment, variable annuities have longer accumulation durations than taken care of annuities. The majority of variable annuities are deferred annuities, implying your income stream does not begin till years in the future.

Decoding Fixed Vs Variable Annuities A Comprehensive Guide to Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Is Worth Considering Indexed Annuity Vs Fixed Annuity: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Vs Variable Annuity Pros Cons Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Interest Annuity Vs Variable Investment Annuity FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Pros And Cons Of Fixed Annuity And Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Both taken care of and variable annuities give you the possibility to enter the annuitization phase, which is when you receive money from your annuity. With fixed annuities, you'll receive income in repaired installments that are ensured to remain the very same. You'll choose when you intend to begin receiving settlements. With variable annuities, the settlements you get will be influenced by the performance of your underlying financial investments.

This might be ten years, twenty years, or forever. The abandonment period is the moment structure during which you can't withdraw funds from your annuity without paying added fees. Surrender durations normally put on just deferred annuities so they can relate to both fixed delayed annuities and variable annuities.

Living benefits affect the earnings you get while you're still alive. As an example, you could wish to include an ensured minimum accumulation worth (GMAB) cyclist to a variable annuity to ensure you will not lose money if your financial investments underperform. Or, you could want to include an expense of living change (COLA) cyclist to a taken care of annuity to aid your repayment amount stay on par with inflation.

If you would love to start receiving earnings settlements within the next 12 months, an immediate set annuity would likely make even more feeling for you than a variable annuity. You might consider a variable annuity if you have more of a tolerance for danger, and you 'd like to be extra hands-on with your investment choice.

One of these differences is that a variable annuity might supply payout for a life time while common funds may be depleted by withdrawals on the account. One more crucial difference is that variable annuities have insurance-related costs and mutual funds do not. With every one of the major and minor differences in taken care of annuities, variable annuities, and shared funds, it is vital to talk to your economic consultant to make certain that you are making clever money decisions.

In a taken care of annuity, the insurance policy company assures the principal and a minimal rate of rate of interest. In other words, as long as the insurer is monetarily audio, the cash you have actually in a repaired annuity will certainly expand and will not decrease in worth. The development of the annuity's worth and/or the benefits paid might be taken care of at a dollar quantity or by a rates of interest, or they may grow by a specified formula.

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Defining Pros And Cons Of Fixed Annuity And Variable Annuity Advantages and Disadvantages of Variable Annuity Vs Fixed Annuity Why Tax Benefits Of Fixed Vs Variable Annuities Is a Smart Choice How to Compare Different Investment Plans: A Complete Overview Key Differences Between Fixed Vs Variable Annuity Pros Cons Understanding the Rewards of Fixed Vs Variable Annuity Pros And Cons Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Deferred Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Annuities Fixed Vs Variable A Beginner’s Guide to Fixed Vs Variable Annuity Pros Cons A Closer Look at How to Build a Retirement Plan

The majority of variable annuities are structured to provide investors lots of various fund options. An equity-indexed annuity is a type of taken care of annuity, yet looks like a hybrid.

This withdrawal adaptability is attained by changing the annuity's worth, up or down, to reflect the change in the rate of interest "market" (that is, the general degree of rate of interest) from the beginning of the chosen period to the time of withdrawal. Every one of the following kinds of annuities are offered in repaired or variable types.

The payment may be a long time; postponed annuities for retirement can remain in the deferred phase for years. A prompt annuity is developed to pay an earnings one time-period after the instant annuity is acquired. The time duration depends on just how commonly the earnings is to be paid.

Understanding Variable Annuities Vs Fixed Annuities Key Insights on Immediate Fixed Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Annuities Variable Vs Fixed Matters for Retirement Planning How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Pros And Cons Of Fixed Annuity And Variable Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuity Vs Fixed Indexed Annuity A Beginner’s Guide to Fixed Vs Variable Annuity Pros Cons A Closer Look at How to Build a Retirement Plan

A set period annuity pays a revenue for a given period of time, such as 10 years. The amount that is paid doesn't rely on the age (or continued life) of the individual who gets the annuity; the repayments depend instead on the quantity paid into the annuity, the size of the payout period, and (if it's a set annuity) a rate of interest that the insurer believes it can support for the size of the pay-out period.

A variant of lifetime annuities proceeds earnings till the 2nd one of two annuitants dies. Nothing else sort of economic product can assure to do this. The quantity that is paid depends on the age of the annuitant (or ages, if it's a two-life annuity), the quantity paid right into the annuity, and (if it's a set annuity) a passion rate that the insurance coverage business thinks it can support for the length of the anticipated pay-out duration.

Many annuity buyers are uncomfortable at this opportunity, so they add an assured periodessentially a fixed duration annuityto their lifetime annuity. With this combination, if you pass away prior to the fixed period ends, the revenue proceeds to your recipients till the end of that duration. A competent annuity is one used to invest and disburse money in a tax-favored retirement, such as an individual retirement account or Keogh strategy or plans regulated by Internal Earnings Code areas, 401(k), 403(b), or 457.

Table of Contents

Latest Posts

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About Financial Strategies Defining Fixed Vs Variable Annuity Pros Cons Advantages and Disadvantages of

Breaking Down Your Investment Choices A Closer Look at Retirement Income Fixed Vs Variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Ri

Understanding Fixed Index Annuity Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why Im

More

Latest Posts